Bullion bars have long been a cornerstone of wealth preservation and investment. Known for their high purity and intrinsic value, these bars are a popular choice among investors looking to diversify their portfolios and protect their assets. In this guide, we'll explore the benefits, types, and considerations of investing in bullion bars.

What are Bullion Bars?

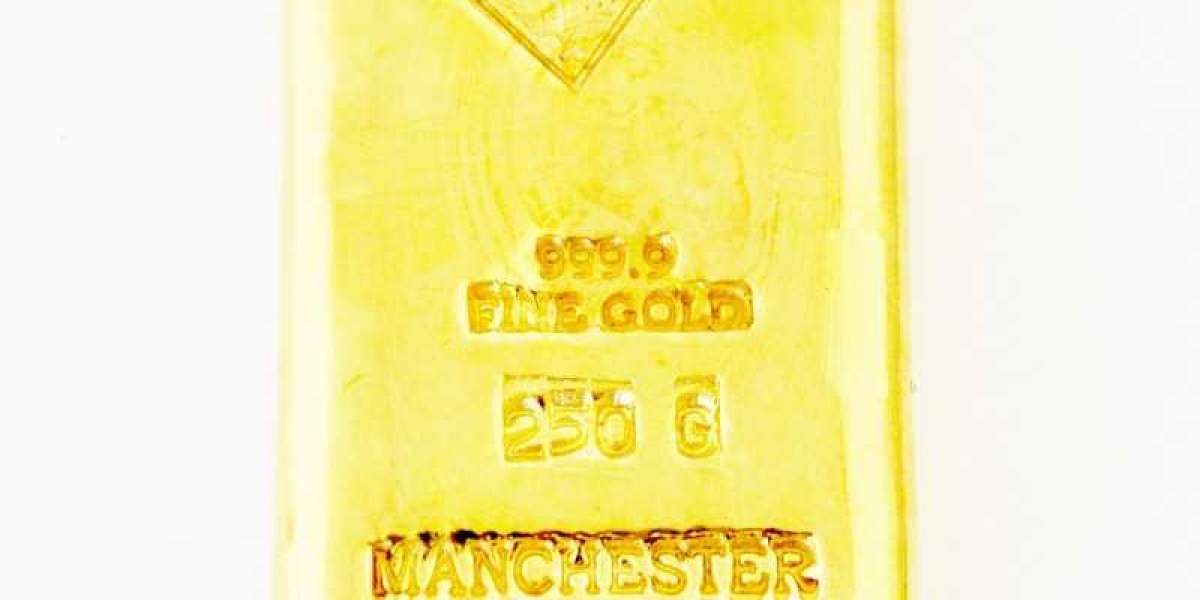

Bullion bars are refined precious metals shaped into rectangular bars, typically made from gold or silver. These bars are valued based on their weight and purity, making them a tangible and reliable investment. The most common types of bullion bars are gold and silver, but they can also be made from other precious metals such as platinum and palladium.

Why Invest in Bullion Bars?

- Stability: Precious metals like gold and silver tend to retain their value over time, providing a hedge against inflation and economic instability.

- Liquidity: Bullion bars are highly liquid assets that can be easily bought and sold on global markets.

- Diversification: Adding bullion bars to your investment portfolio helps diversify your assets, reducing overall risk.

- Tangible Asset: Unlike stocks or bonds, bullion bars are physical assets that you can hold and store.

Types of Bullion Bars

- Gold Bullion Bars: These bars are made from pure gold and are available in various weights, typically ranging from 1 gram to 1 kilogram. Gold bullion bars are popular due to gold’s historical stability and value.

- Silver Bullion Bars: Made from pure silver, these bars are also available in various sizes. Silver bullion is often more affordable than gold, making it accessible for more investors.

- Platinum Bullion Bars: Platinum is a rare and valuable metal, and bullion bars made from platinum offer a unique investment opportunity.

- Palladium Bullion Bars: Palladium bars are another option for investors looking to diversify their precious metals holdings.

Factors to Consider When Buying Bullion Bars

- Purity: The purity of bullion bars is typically expressed in parts per thousand. For example, gold bullion bars usually have a purity of 999.9, meaning they are 99.99% pure gold.

- Weight: Bullion bars come in various weights, from small 1-gram bars to large 1-kilogram bars. Choose a weight that fits your investment goals and budget.

- Manufacturer: Opt for bullion bars from reputable manufacturers such as PAMP, Valcambi, or the Royal Canadian Mint. This ensures quality and authenticity.

- Certification: Ensure the bullion bars come with an assay certificate, which guarantees their weight and purity.

- Storage: Consider where and how you will store your bullion bars. Options include home safes, safety deposit boxes, and professional storage facilities.

Where to Buy Bullion Bars

- Banks: Many banks offer bullion bars for sale, providing a secure and trustworthy purchasing process.

- Precious Metal Dealers: Reputable dealers, both online and offline, offer a wide range of bullion bars.

- Mints: National and private mints often sell bullion bars directly to the public, ensuring high quality and authenticity.

- Auctions: Bullion bars can occasionally be found at auctions, particularly those specializing in precious metals.

Tips for Buying Bullion Bars

- Research: Stay informed about current precious metal prices and market trends to make well-timed purchases.

- Compare Prices: Shop around and compare prices from different sellers to ensure you get the best deal.

- Check Reviews: Look for reviews and testimonials about the seller to verify their reliability.

- Secure Payment: Use secure payment methods and ensure the seller’s credibility before making a purchase.

- Understand Fees: Be aware of any additional fees, such as shipping, insurance, or storage costs.

Storing Your Bullion Bars

- Home Safe: Investing in a high-quality home safe can provide secure storage for your bullion bars.

- Safety Deposit Box: Banks offer safety deposit boxes for secure, off-site storage.

- Professional Storage: Some dealers and mints offer professional storage services in secure vaults.

Conclusion

Investing in bullion bars is a strategic move for anyone looking to diversify their investment portfolio and secure their financial future. With their high purity, liquidity, and stability, bullion bars offer a reliable way to protect and grow your wealth. By understanding the different types of bullion bars, considering essential factors, and purchasing from reputable sources, you can make a smart investment in this timeless asset. Whether you are new to investing in precious metals or an experienced investor, bullion bars are a valuable addition to any portfolio.